Episodes

Why Smart Money Is Buying Energy Chaos (Saul Kavonic)

We continue our exploration of the energy space with today’s guest, Saul Kavonic. Saul covers the Australian energy sector as an analyst with MST Financial and has been a prolific commentator for a number of years with many h...

The Ultra Bull Case for Lithium (YJ Lee)

Today we're sharing our conversation with YJ Lee, founder of the Arcane Green Metal Fund, fresh off an incredible 165% return in 2025. YJ breaks down the explosive dynamics driving lithium and silver markets, and why we're on...

The Strategic Metals Awakening (Craig Tindale)

Today we’re sharing our conversation with Craig Tindale, author of the widely read “Return to Matter” paper. Craig’s writing captures the fragility of the situation that the West finds itself in, as China’s dominance in the p...

Is Oil the Next Commodity to Rip? (Josh Young)

We’re branching out for this episode. Today, it’s all about energy. As metals markets have moved violently higher across the board, we called on Josh Young to hear his take on where we are in the energy cycle. We’re hunting f...

11 Listeners Pitch Their Top Mining Stocks

We threw the bone out there (via Twitter) and asked the great crowd of mining investors & speculators for their best ideas. A simple 5-min spiel on why you think the company is going places. Today’s episode is that conversati...

Huw McKay Makes Sense of the Chaos

Today, we’re sharing a conversation with BHP’s former head economist and ANU Visiting Fellow, Huw McKay. Huw is an incredibly deep thinker about global commodity markets, geopolitics and financial systems, making him the perf...

Coal in 2026: The Energy Inflection Point (Matt Warder)

With coal stocks moving strongly of their lows of 2025 and the funding landscape being flipped on its head, we called upon the most knowledge person in the sector, Matt Warder, to give us the run down.In this conversation we ...

The Spine-Tingling Metals Bull Market (John Forwood)

In today’s show we bring back on the man behind Lowell Resources Funds stellar returns, John Forwood. With his geological experience and stock picking nous, John shares what’s exciting him and equally what’s got him concern i...

Why Generalists Can’t Ignore Commodities Anymore (Sam Berridge)

Sam Berridge of Perennial Value Management joins us to pick apart the huge start to 2026 in the commodity markets. With gold pushing toward $5,000, copper at all-time highs, and generalist investors looking to flood back into...

Riding the Face-Ripping-Rally with Tom Woolrych

Tom Woolrych, fund manager at Deutsche Rohstoff AG, joins us to reflect on the remarkable commodity rally underway. With Tom's Geo-Alpha approach, we dig into Q2, Winsome, Wildcat, Wia Gold, Hot Chili, Peel, Adina, Dwayne Spa...

2025: Will We See Another Year Like It? (Peter Ker)

Our final episode for 2025 is our outro classic, with none other than the AFR’s Pete Ker joining us. In this special episode, we unpack the biggest stories of the year, including: • Geopolitics changing the game • Big-town M&...

Mining Private Equity Unmasked (Fraser Perry)

Today we’re going deep into the world of mining private equity with Fraser Perry. If those words don’t mean an awful lot to you, don’t worry, because we’re going back to basics. We break down: • What mining PE is • The scale ...

30 Fundies’ Highest Conviction Trades for 2026 (Part 2)

The second half of the 30 top fund managers share their boldest predictions for 2026 in the commodities sector. Each guest answers the same four rapid-fire questions: • Their highest conviction call • Most non-consensus view ...

30 Fundies Share Their Best Picks for 2026 (Part 1)

In part 1 of this special episode, we bring together 30 top fund managers to share their boldest predictions for 2026 in the commodities sector. Each guest answers the same four rapid-fire questions: • Their highest convictio...

How a New Global Order Is Rewriting Commodity Investing (Tomasz Nadro…

Tomasz Nadrowski is one of the deepest thinkers in the natural resources sector, and we finally got him on the show. From his position in New York, Tomasz's fund invests purely in non-Chinese critical mineral plays – a challe...

Why The Mining Boom is Just Beginning (Hedley Widdup)

Where are we in the mining cycle? That’s the question we look to answer today. Hedley Widdup joins us to discuss his views on the current mining boom, which is slowly revealing itself, as well as a raft of other topics, inclu...

The Copper Sleeper that Nobody’s Watching (Anthony Kavanagh)

Today’s episode is a bit different. Joining us is show favourite Anthony Kavangh, to share his view on a specific stock… Havilah. Kav has been on a long and winding road as an investor in the South Australian copper hopeful a...

Why BHP Will Return for Anglo (Again)

We’ve got a special episode to share today, full of yarns about all the biggest stories in mining. A recurring deal that’s near and dear to has returned once more… its BHP-Anglo version 2. The lithium market has provided no e...

10 Strategic Metals: Overrated or Underrated? (Jack Bedder)

Today’s guest is Jack Bedder, a man who’s built a business around understanding some of the most niche and fascinating metals on the planet. In this episode, we dive into 10 of the world’s hottest future-facing commodities – ...

No Spin, Just Tin. Brett Smith on MetalsX and Every Tin Project

Brett Smith joins us for an unexpectedly open conversation about Metals X, its turnaround and the state of the global tin industry. We have criticised Metals X in the past, which makes Brett an unlikely guest, but he leans st...

The Current Commodity Supercycle (Paulo Macro)

Today’s episode is a wide-ranging conversation with Paulo Macro. Paulo’s been sharing some fantastic and thought-out views on many commodities, as well as his all-encompassing that we’re in a new supercycle. He details and ex...

The Lundin Legacy (Adam & Jack Lundin)

Our guests today are Jack and Adam Lundin, of the renowned Lundin Family, a name synonymous with value creation and long-term thinking in the mining sector. We were fortunate to record a conversation that delves into their ph...

Mick McMullen on Deals, Discipline and Activism

What does it take to create billions in value – and reshape an industry? In this episode, industry veteran Mick McMullen shares lessons from the front lines of major deals and corporate strategy, with insights from his roles ...

What Gold’s Past Tells Us About Its Future

We’re mixing it up today with a different kind of episode featuring a Money of Mine favourite, Sean Russo. Sean’s a fountain of market & mining knowledge, and we tap into it to uncover: • What history teaches us about how to ...

Smart Money is Buying-the-Dip in Copper and Gold

For today’s wrap we’ve brought of Dave Franklyn from the Argonaut Natural Resources Fund. Dave helps us navigate through a bunch of macro talking points, from the big US government nuclear deal to gold’s volatility and copper...

The Playbook Behind Evolution’s $20B Gold Success

This is the story of how Evolution Mining rose from a junior with a busted project to be one of Australia’s best business success stories, all in under 15 years. We trace the journey back to the Sino Gold days, uncovering how...

From Royalties to Real Assets: Smallwood, Awram, and Jay Martin

In today’s episode, we’re sharing highlights from 3 great conversations we recorded on air at IMARC. Our guests are David Awram, co-founder of the recently acquired Sandstorm Royalties, Randy Smallwood, CEO of the US$45B Whea...

Jeff Phillips: 2 Details That Make or Break a Mining Bet

In today’s episode we’re sharing our discussion with resource investor Jeff Phillips. Jeff has near on 30 years’ experience speculating in the natural resource business, and along the way he’s crafted a simple and effective a...

The Dollar Cracks. Ferg’s Back. Why Hard Assets Win.

Ferg Cullen (aka Trader Ferg) joins us for a wide-angle look at the market’s many dynamics front of mind this week. We unpack BHP’s quiet shift to RMB settlement, the end of dollar dominance, and what it means for commodities...

Rob Mullin: Gold Stocks Still Cheap, Energy Stocks Cheaper

We continue our search for the world’s best natural-resource investors with today’s guest, Rob Mullin. Rob is the Founder and CIO of Marathon Resource Advisors , a long-short fund that has compounded at extraordinary rates by...

Gold Goes Vertical, We Hunt for Value (Ben Richards)

With us for this week’s Weekly Wrap is Ben Richards, co-portfolio manager at Seneca. Ben helps us navigate all the wild market action, starting with a discussion on gold and all the companies that’ve pre-reported quarterly pe...

Australia’s Most Successful Gold Explorer

We had the privilege of sitting down with legendary explorationist Ed Eshuys, widely credited with the Plutonic, Bronzewing and Jundee gold discoveries. Ed takes us inside the second-last hole that lit up Bronzewing, how CSIR...

Gold Soars & China Corners BHP (Jeff Quartermaine)

We had the privilege of being joined by the outgoing Perseusboss Jeff Quartermaine for the latest Weekly Wrap episode. The conversation began by unpacking Jeff’s 12-year rein as CEO to his ultimate departure, having built a ~...

Gold Mania, Niobium Dreams, and Antimony Nightmares (Datt)

In Today’s episode is an across-the-board conversation with Melbourne based fundie Emanuel Datt. We kick off by hearing how he’s thinking about the excess and frothy behaviour we’re seeing in markets, segueing into gold, gold...

Inside a $3.8B Gold Deal + The US Wakes Up

On this week Weekly Wrap, we’re joined by Gold Road CEO Duncan Gibbs , as he puts the finals touches on the company’s $3.8B takeover by Gold Fields. We discuss the journey and get the inside details of the takeover, before mo...

Shrub Unplugged: Gold, Grift & Debasement

In this episode, we sit down with Le Shrub for a wide-ranging conversation on today’s markets - what he calls the Golden Age of Grift . From currency debasement to the rolling Ponzi cycle, Shrub lays out why valuation no long...

Majors Panic Amid Market Madness (Koala)

This week’s wrap is action-packed, featuring the Koala( @YellowLabLife ). We kick off with his takeaways from Beaver Creek and theWorld Nuclear Association conference – then jump into the froth and speculation sweeping the se...

The Fremantle Fundie that picked WA1 at 20c and Almonty at $1

We sat down with Peter Prendiville and Chris Wiener, the people behind Norfolk Capital Management . Norfolk is one of the newest resource funds on the block. While being new, Norfolk’s returns have been spectacular since the ...

Anglo Teck Mega Merger... and a Retail Revolt

This week’s wrap is packed – featuring special guest James Nicholls, a resources M&A lawyer with an abundance of deal-making experience. We kick off with the industry’s biggest shake-up in a decade: Teck and Anglo American’s ...

Contrarian Bets: Brian Laks on Lithium, Coal & Uranium

Coal and lithium are down 60 - 90% from their highs, uranium stocks have risen tenfold, and copper is on the cusp of breaking out. Where does a contrarian put capital next? In this episode, Brian Laks (Old West Management) sh...

Gold Takes Off, Rates Bite, Miners Rip

Gold is flying, rates are being lowered, and mining equities are finally waking up. A punchy tour through a risk-on week for gold and real assets, field notes from Africa Down Under, and three segments: Grade Control, Sweet/S...

Gold Miners That Actually Compound (Greg Orrell)

We’re excited to share a candid conversation with Greg Orrell — veteran fund manager and head of the OCM Gold Fund . With more than 30 years as a fund manager, Greg has seen plenty of booms, busts, and boardroom mistakes in t...

How a Multipolar World Reshapes Mining (Michael Willoughby)

This week we’re joined by Michael Willoughby of Pacific One Capital for the wrap. With his unique experience, Willo is the perfect guest to break down the shifting trends in how miners are getting financed and the geopolitica...

Hanging Out in Hated Places with Rick Rule

In today’s episode, we’re joined by renowned resource investor Rick Rule to explore where the most overlooked pockets of value lie in the market. Our conversation covers the most beaten-up parts of the market, whether there’s...

Buybacks, Cost Curves & Dingo’s Picks

Daniel Dingo Harangozo of Nero Resource Fund is joins us on the mic as we review the big events of the week just gone. And there's no bigger news that China’s push toward “anti-involution” and what it means for commodity mark...

Lithium’s True Inflection Point (YJ Lee)

With so much unfolding in China across the battery metalsspace, we sat down with YJ Lee at the perfect time. YJ runs a fund focused on the energy transition and bringsdeep expertise in both metals and battery markets. In this...

Lithium Mayhem and Mozal Woes (Sam Berridge)

We’ve got a new style of show that we’re pumped to share. The weekly wrap covering all the big stories in detail plus plenty highlights. We’ve got analysis, ratings and hot takes. And we're joined by Sam Berridge, Portfolio M...

Booms, Busts & Billion-Dollar Builds (Zimi Meka)

We’re thrilled to bring you a candid conversation with ZimiMeka — co-founder and CEO of Ausenco , one of the world’s top mining engineering firms. From the soaring highs to unbearable lows, Zimi sharesstories of building mine...

The Unbelievable Story of how Fortescue Beat the Odds

Today’s episode is an exploration into the story behind one of Australia’s greatest business success stories, Fortescue. The company has paid over $42B in dividends in its brief history, which began at Andrew Forrest’s kitche...

The Best Ideas from Diggers & Dealers 2025

We kick things off with Australia’s bold indication to set arare earth floor price – a page right out of the US playbook – and then dive into the big question: Will the government step in to rescue all our struggling smelters...

Horror Week for Boss, Greatland and Liontown

With the quarterly season wrapping up, we pick apart the most interesting updates in the market. First up: Boss Energy. A leadership shake-up and a cloudedoutlook for Honeymoon saw the share price halve. Then to Liontown, who...

The Great MinRes Debate: Bull vs Bear

Today’s episode is a conversation on what remains Australia’s most intriguing company, Mineral Resources (aka MinRes).We invite on Moz, who unpacks with us his thesis for investing in the diversified miner after publishing hi...

2 Geos Interviewed 100+ Top Discoverers — Here’s What it Takes (Steve…

We’re delighted to share this passionate and energeticconversation with Steve Beresford and Ahmad Saleem. With Steve and Ahmad, we dive into the problems they set out to tackle when they launched their timeless podcast, Explo...

Finding Alpha Where Others Fold with Muddy Waters’ Darren McLean

Today’s episode is a conversation that completely drew us in— with Canadian resource fund manager Darren McLean. Darren is a thoughtful and passionate investor, focused onfinding unloved and overlooked stocks. He follows comp...

The 9 Red Flags in Exploration Investing (Roland Gotthard)

There’s plenty of alpha to be made — and money to be saved — by learning from a sceptical geologist. So we interviewed one. Roland Gotthard has built a reputation for calling out poordisclosure practices, guiding investors on...

Will Gold Stocks Protect You in a Crisis? (Dirk Baur)

Recent wild volatility in markets has led us to reflect ongold, so we thought why not chat with the man who’s spent more time than most thinking about the precious metal… Dirk Baur. Dirk was kind enough to share his wisdom fr...

An Unfiltered Chat with Wyloo (Luca Giacovazzi + Joel Turco)

We’re sharing a chat today that we immensely enjoyedrecording. Luca Giacovazzi and Joel Turco, who lead Andrew Forrest’s private mining business Wyloo, joined us in the studio to have a conversation on a wide range of experie...

Why the World’s Biggest Funds Get Mining Wrong (David Sparks)

We’ve got the pleasure of sharing a conversation with David Sparks — an investor in the natural resources world with experience at some of the world’s biggest hedge funds, including the famed multi-strat firm Millennium, as w...

We Surprise Call 3 Fund Managers....

We went a bit rogue today with a completely different dailyepisode style. Financial markets, mining and commodities are at a fascinating inflection point, and we wanted to hear what some of the smartest people in markets are ...

Undervalued Copper, Twitter Activism and IperionX with Hank Ruehl

We mix things up today with a daily show and interview allin one as we’re joined by Hank Ruehl, who is a natural resource investor through the fund he founded, Sierra Morena Capital. We dive into the latest escalations in the...

Paladin’s CEO Exit: Cause for Concern?

To kick things off today we pick apart Paladin’s announcement that CEO Ian Purdy will step down and look at what the future could hold for the uranium miner. We then venture to West Africa where Predictive shared their DFS nu...

Know This Before Investing in African Miners

Nothing gets us excited like a bidding war. The Rack Attackin Arizona ft. New World Resources, Kinterra Capital and CAML is delivering on all fronts, we share the latest here plus explore the rising trend of resource national...

The Most Exciting Mining Deal of 2025

Hostile M&A is back! Kinterra Capital and CAML are going head-to-head in their quest to take out New World Resources, giving us no shortage of enjoyment. We also picked up on a chunky financing package for Asante Gold, who ha...

Uranium Goes Vertical. Overblown or Only the Beginning?

We kick off with the wild moves sweeping through uranium, breaking down SPUT’s raise, the squeeze mechanics, and whether valuations have run too hot. Next up: the drama at New World Resources, where a bidding war could be bre...

Rare Earths Reality: Hype vs Hope with 3 Experts

We have been struggling to make sense of the headlines in the rare earths market lately. What's relevent? What's real? Why do the equities make no sense? To piece it together, we've pulled together a conversation with 3 very ...

Why Tether’s Gold Mining Royalty Play is a Massive Deal

There has hardly been news in the mining world that’s left us as stunned as Tether (yes, the crypto company) buying a huge stake in royalty group, Elemental. We had to unpack it. On the other end of the spectrum, a struggling...

How Northern Star Became Australia's Biggest Gold Miner

How does a shell company turn into Australia’s biggest goldminer, capped at nearly $30 billion? In this episode, we unpack the fascinating story of NorthernStar — from 2c a share to over $20, securing world-class assets acros...

The Art of Commodity Investing (Taylor McKenna of Kopernik)

Today we’re sharing our conversation with Taylor McKenna of Kopernik Global Investors. We’ve long wanted to chat with Kopernik, given their strong value investing orientation, the fantastic research papers they’ve shared and ...

Why Mega Deal "GlenTinto" is On (with Koala)

For today’s show we welcome back the Koala. It’s been a busy period of big announcements on the global mining stage, with Rio’s CEO announcing his resignation, Glencore seemingly prepping for a deal, Harmony Gold bidding for ...

What's Gone Wrong at Ivanhoe? (Neil Ringdahl)

On the show today we’re joined by Neil Ringdahl to pick apart the challenges at Ivanhoe’s Kamoa-Kakula. Neil technical background made him the perfect person to walk us through the news that shook Ivanhoe. The seismic events ...

The Secret Masterplan of ASX’s Most Loved Miner?

Today’s show covered it all, from a deep dive into WA gold to what it takes to turn a company into an institutional-grade powerhouse. From the Genesis deal to snap up Focus Minerals’ Laverton project, to the growth plans, we ...

Iron Ore Top Dogs Argue About Who is #1

This week, we hit the Fin’s Mining Summit and rubbedshoulders with the who’s who of Australia’s mining elite. We decide to break down the big themes everyone’s debating — who’s really top dog in iron ore, which miners should ...

Will a bidding war begin on this copper junior?

Xanadu finally received a cash bid, but it came from anunexpected bidder. We’re hooked and naturally, we explore the likelihood of a bidding war should Zijin feel the pressure to bid now. The most publicised sale process at t...

Market Intel from a Commodity Trader & China Analyst

Commodity trader Bentley Attebery and China macro analyst Rogan Quinn join us for a unique conversation. The pair delve into the current dynamics of commodity markets, particularly focusing on China's economic activities and ...

Never Compromise on Stock Quality (Dave Franklyn)

In today’s episode, we invited on Dave Franklyn of Argonaut Funds Management. We thoroughly enjoyed this conversation, which traversed many topics, including how to make sense of the macro environment, why Dave never compromi...

Lots of confusion with Liontown... and with Money of Mine

It’s been a big week at Money of Mine, so we start today’s show with an open yarn about it. To get back into the swing and talk about what we’re fascinated by, we dove in a big story. Why Liontown has run so hard and what the...

Navigating Market Chaos with Resource Investor Will Thomson

Will Thomson of Massif Capital has a unique way of thinking about opportunities so we were thrilled to cover topics including tin and the DRC, copper and Zambia, USA’s growing understanding of mineral importance, gold miners ...

Fund Manager David Finch has message for Gold Miners

Fund manager, David Finch of Ixios Asset Management kindly joined us to explore the full spectrum of mining equites. We largely discuss the state of gold miners who will be flush with cash at current gold prices. The question...

Mastering the Lassonde Curve’s Valley of Despair (Rick Squire)

Today’s show is a fantastic chat with fund manager Rick Squire. We covered a heap of ground, from the possibility of a rare earths rebound, to where there’s value in the gold sector, as well as prioritising companies of scale...

The 5 most interesting mining deals this week

A quick wrap up for the week as we rapid fire run through the five most interesting deals of the week. Plus we can't let the late quarterly reporters get away without our signature Name and Shame segment. Sign-up for the Dire...

Taking the pulse on junior miners with John Forwood

In today’s show we had the pleasure of chatting with junior mining specialist John Forwood. John is a wealth of knowledge when it comes to the explorers, so we picked his brain on interesting commodities, where pockets of val...

Has MinRes Really Turned the Corner?

We’re in the thick of quarterlies now, so we plucked out 2 of the most fascinating stories to chat about. First up we dived into MinRes, who saw their stock rocket 15%+ on the back of their release. And for our second story, ...

Datt Capital get vocal over Koonenberry incentives

We start the week with a bit of shareholder activism, as Datt Capital launched a 249D to make some board changes at gold exploration bolter Koonenberry. Our second story for the day is a gold Merger of Equals, with Alkane and...

Unpacking the Ramifications of the Gold Pain Trade with Sam Berridge

Given all that’s transpired in markets lately, we felt overdue a discussion Perennial Value Management’s Sam Berridge. As always, Sam shared his thorough and nuanced perspectives on a range of topics, starting with the macro ...

Why this ‘Big Short’ billionaire bought a gold mine

Why this ‘Big Short’ billionaire bought a gold mine? Also, are Liontown slowly making it work? Along with Paladin’s rebound on quarterly pounds and Albanese’s announcement of a strategic minerals reserve. Sign-up for the Dire...

Who’ll benefit most from gold mania?

With gold rocketing, we start the show by running through interesting undeveloped Aussie gold projects flying under the radar. Next we move to MP Materials, which has been caught in the cross hairs of the trade war, followed ...

Some precious metals booming, some in the doldrums (Sam Broom from Sp…

Sam Broom, Investment Executive at Sprott, returns after his XMAS 2024 cameo. Sam loves looking at which sectors have been punished for a long time, anticipating when they are going to re-emerge. We talked precious metals (go...

An unfiltered conversation with Mr Lithium

It had been far too long, so for this special episode, we invited back Joe “Mr Lithium” Lowry. We discussed Joe’s fantastic recent write-up on the evolution and geopolitical strategy at play in the lithium sector, what the We...

The different styles of resource investing

We’re in quarterly season now, with the cash building Genesis grabbing our attention first up. Next, we ventured east to chat about the rise and rise of Aurelia, as their Federation mine comes to the fore. Lastly, we look at ...

Can Greatland pull off the great comeback?

Copper hopeful Prospect Resources has tied up a strategic investment from neighbour First Quantum at a premium, seeing their stock jump. Greatland Gold saw a solid result, and we dive into how rare earths are taking centre st...

Is this the final reset for Bellevue?

There’s only one story to chat about today… Bellevue. We go into the ins & outs of the new mine plan, the capital raise, the prospects of a takeover and a whole heap more. Sign-up for the Director’s Special Please read our Pr...

Focusing on fundamentals amid volatility (Matt Fist of Firetrail)

Matthew Fist, Portfolio Manager of the Firetrail Small Cap fund, breaks down how he’s making sense of markets, his preference to focus on bottom-up fundamentals in times of macro volatility, and how he’s positioning the fund ...

Tin to the Moon: Paused – For now

As global markets rocketed, tin got smashed on the back of the news that Alphamin would be making a staged restart of the Bisie mine. We then delved into the latest in the Gold Road – Gold Fields saga, with the target seeming...

The Future of Mining with Alan Broome

Today’s show is a great discussion with the vastly experienced Alan Broome. We looked at what the mines of the future will look like, where the low hanging fruit is in respect to innovation, how Australia can stay ahead of th...

Taking stock of the lithium sector with whiz kid Daniel Rau

There are lots of unknowns in the ever-evolving lithium market: think supply, demand, geopolitics, technology and battery chemistry. Today, emerging young gun Daniel Rau joins us to discuss this. We explore the current market...

The miners most exposed to a meltdown…

Markets started Monday in freefall, so we talked about the implications for Aussie and global miners. We then delved into Rio Tinto’s activist battle with Palliser Capital and touched on uranium market dynamics too. Sign-up f...

We ask Hedley Widdup about every gold mining junior

The gold price is flying, can you believe it’s soared beyond A$5,000 per ounce? We ask Hedley Widdup of Lion Selection Group about every single gold junior we can think of. We don’t think we even talk about a single producer ...

Is a Bid 3x Your Share Price Irrefusable?

First up today is the punchy bid that Huayou & Renault chucked up for Galan’s assets, leading it to jump 45%. Then, we discuss possibilities in anticipation of Bellevue’s release, we look at Ramelius’ pre-reported quarterly a...

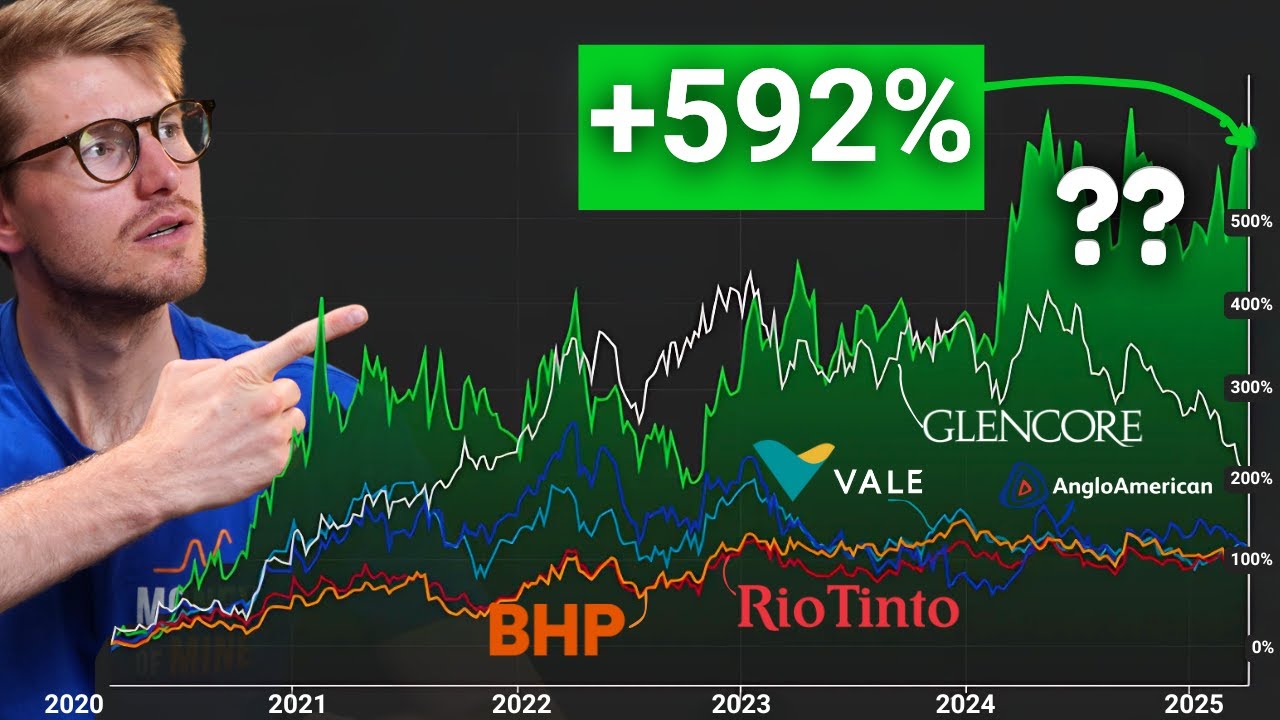

The Mining Giant That Has Outperformed Every Major

We go big today, with a chat about 2 of the biggest and best performing companies in the natural resource world. Zijin Mining + Franco Nevada. We peel into why they’ve outperformed and try to extract what can be replicated. T...

Will M&A spark life into lithium?

We start the week by chatting about rumoured M&A in the West Australian lithium sector, with a group of Indian groups reportedly interested in buying a stake in SQM’s assets. Then we venture into the world of antimony by diss...